Child Investment Fund

As human beings, there are hardly any stronger aspirations than providing the best of everything for your children. But for every dream to be realised, we have to cross the bridge of multiple realities. As a parent, the most obvious of the dream would be to plan for your children in such a way that all their future requirements are properly taken care of and there is no running around at the time when the actual requirement arises.

The purpose of Children’s Future Planning is to create a corpus for foreseeable expenditures such as those on higher education and wedding, and to provide for an adequate security cover during their growing years.

Like most parents, you might be saving regularly to ensure a safe tomorrow for your child. However, savings alone is no longer enough.

For ensuring adequate funding of your child’s education, you as a parent need to do 2 things:

Invest appropriate amount systematically and at regular intervals.

Provide for a financial security blanket to cover any eventuality.

In current times signified by fast up and faster down economic cycles (a lot of uncertainty and volatility; food prices move up and down after a specific time period; the same is true of stock markets, prices of gold, copper, aluminium etc), it is very well possible that you, as parents, are caught on the wrong foot sooner rather than later. As the saying goes ‘Time and Tide waits for none”, very soon parents of young children would realise that they are looking at times when a particular need of their children is staring them in the face and they are found wanting in terms of how to tackle that need.

Higher Education & Marriage

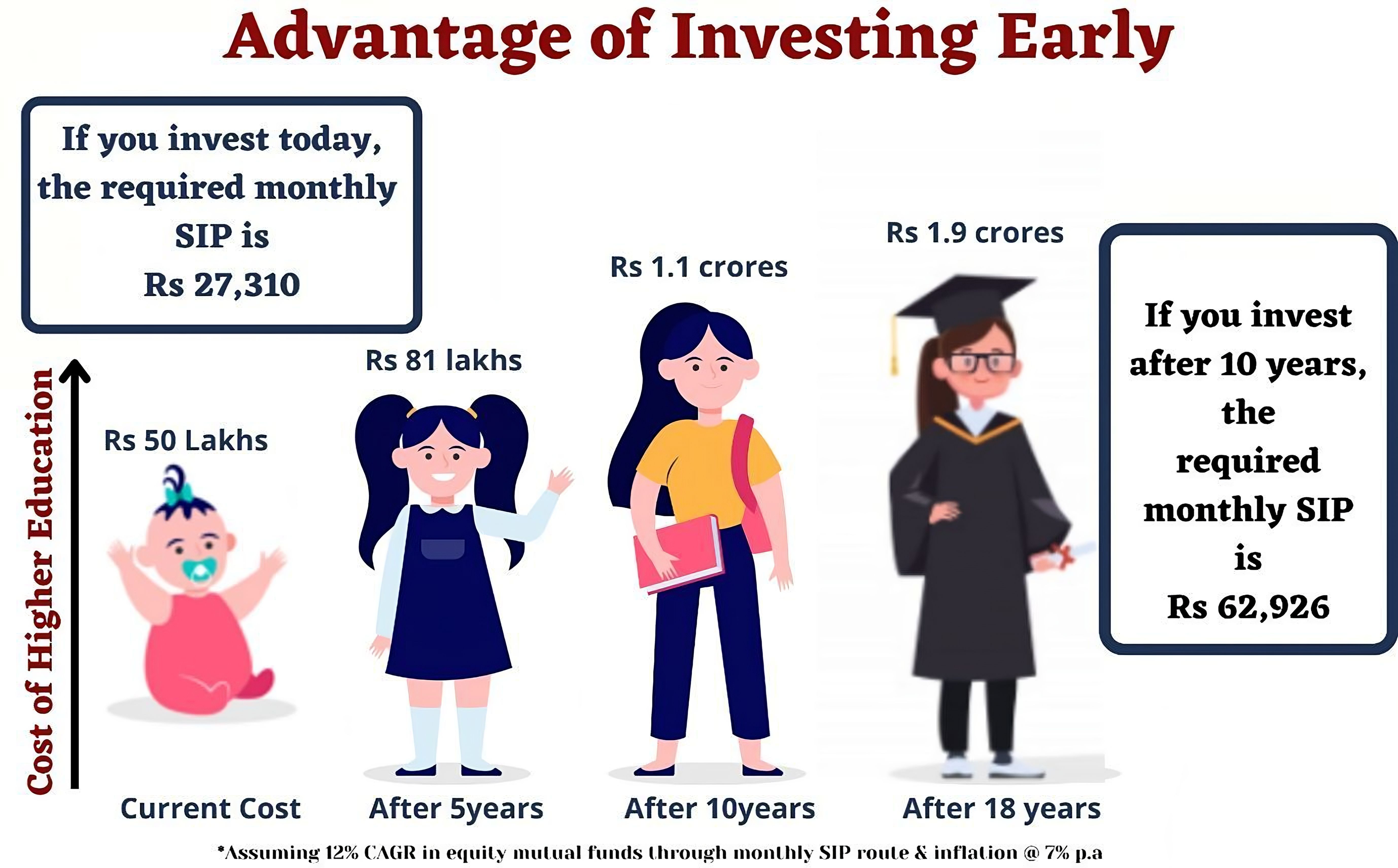

Two needs which need maximum attention and planning from parents (especially modern-day parents) are higher education and marriage. Within no time, parents realise that their tiny tots have grown up and it’s time for them to decide future course of their life in terms of profession they want to take. Funding for your children’s education and wedding is one of the most valuable gifts you can give them and it is possible for you to do it in the most uncompromising way. Look at the figures below to get an idea of what could be the expenses like when you start to plan:

Currently the average cost of professional courses like Bachelors in Engineering in India in a Govt-funded college is around Rs.50,000 per year (this figure may differ from college to college and from one state to another). Add to that other expenses like tuition fees and miscellaneous expenses and the cost per year could very easily be around Rs.1,00,000. It could be up to Rs.2,50,000 Lakhs a year if the child stays away in another city for this education. 10 years down the line, this figure might well be Rs 5.5 lakhs per year due to inflation (considered at a reasonable 8% per year) and it could be about Rs.80,00,000 per year 15 years later. If the college is private-funded, multiply the figure by 3-4 times, and if you are more ambitious and are looking at any of the world’s top universities, further multiply the figure by 2-3 times more!! And this is the cost of one year of education out of the 4-5 year’s total education.

The other event that assumes equal, if not more, importance is the wedding of your children. A back of the envelope calculation reveals that monetary requirement for wedding will certainly not be less than what you may need for higher education. In fact, a normal, dowry-less marriage for a daughter today would cost Rs.20,00,000 Lakhs while for the son too, it would be Rs.6,00,000. 10 years down the line, these figures become Rs,43,00,000 and Rs.13,00,000 lakhs respectively.

Don’t get scared by these numbers. The purpose of projecting these exorbitant numbers is not to scare you but to reinforce the point that once you start your family, the planning for your children has to start soon enough. With things changing at a rapid pace around us, these numbers are bound to move only in one direction, and that is, northwards. The overall figure may seem intimidating or out of reach at this stage but with careful planning, early savings along with realistic and practical investment approach, it doesn’t need to be that difficult to achieve.

Starting early and consistency in savings are the two key factors in achieving your child’s successful future planning

Children Plans - Hybrid - Equity Oriented Fund - [Children Future - Education & Marriage] Axis Childrens Gift Fund - Regular Plan - Growth Option HDFC Childrens Gift Fund - Regular Plan - Growth Option Aditya Birla Sun Life Bal Bhavishya Yojna - Regular Plan - Growth

Gold Fund

Benefits

Diversification across Financial Assets

Hedge against Inflation

Safe Investment

Liquidity

Nippon India Gold Savings Fund - Regular Plan - Growth Option Aditya Birla Sun Life Gold Fund - Regular Plan - Growth Option Invesco India Gold Fund - Growth

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.